Ira tax deduction calculator

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Open an IRA Explore Roth vs.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

And is based on the tax brackets of 2021 and.

. The after-tax cost of contributing to your. It is mainly intended for residents of the US. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Traditional or Rollover Your 401k Today. If you would like help or advice choosing investments please call us at 800-842-2252. Paying taxes on early distributions from your IRA could be costly to your retirement.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. The maximum annual IRA contribution of 5500 is unchanged for 2016. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually.

If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600. Reviews Trusted by 45000000. It is important to note that.

Ad Help Determine Your IRA Contribution Limit With Our Tool. You can add another 1000 to that. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Married filing jointly and your spouse is covered by a plan at work. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. Many factors can affect your eligibility and contribution limits to either the Traditional IRA or Roth IRA tax filing status your current earned income level and whether or not you participate in a. While long term savings in a Roth IRA may produce.

Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. We are here to help. While long-term savings in a Roth IRA may.

You can adjust that contribution down if you. The after-tax cost of contributing to your. Traditional IRA Tax Deduction Income Limits in 2021 and 2022.

Ad Make a Thoughtful Decision For Your Retirement. Compare 2022s Best Gold Backed IRAs from Top Providers. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

Calculate your earnings and more. The after-tax cost of contributing to your. This calculator assumes that you make your contribution at the beginning of each year.

In 2020 the standard contribution limit is 6000 for individuals and if youre age 50 or older it increases to 7000. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. A full deduction 6000 or 7000 if youre at least.

Certain products and services may not be available to all entities or persons. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction.

The contribution limit is also impacted by your filing status and whether. If you have a traditional IRA rather than a Roth IRA you can contribute up to 6000 for 2021 and 2022 and you can deduct it from your taxes. Retirement plan at work.

Use our IRA calculator to see how much your nest egg will grow by the time you reach retirement. Save for Retirement by Accessing Fidelitys Range of Investment Options. Save for Retirement by Accessing Fidelitys Range of Investment Options.

Avoid Paying Double Tax On Ira Contributions Rodgers Associates

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Payroll Taxes Aren T Being Calculated Using Ira Deduction

Download Free Traditional Ira Calculator In Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

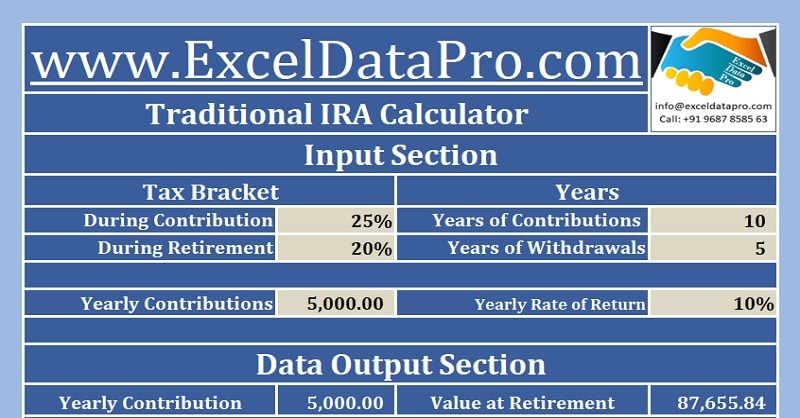

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Ira Calculator Excel Template Exceldatapro

Traditional Ira Calculations Youtube

Roth Ira Calculator Excel Template For Free

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Federal Income Tax Templates Archives Msofficegeek

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution